Modernizing Franchise Research: Analytics, Benchmarking, and Diligence

We all know the big food franchises - McDonald's, Jimmy Johns, Taco Bell.

Beyond restaurants, there are thousands of additional concepts in Fitness, Senior Living, Home Services, Pet Care, etc.

Collectively, U.S. franchise systems drive an estimated $936 billion in annual economic output through the sale of goods and services. That economic footprint grows each year as new brands emerge, mature brands expand, and private equity capital flows into franchising.

FDDs: The Closest Thing Franchising Has to a “10-K”

Every franchise system is required to publish a Franchise Disclosure Document (FDD) annually. For prospective franchisees, the FDD is the closest equivalent to a 10-K filing in public markets.

It includes 23 standardized disclosure items designed to answer key diligence questions such as:

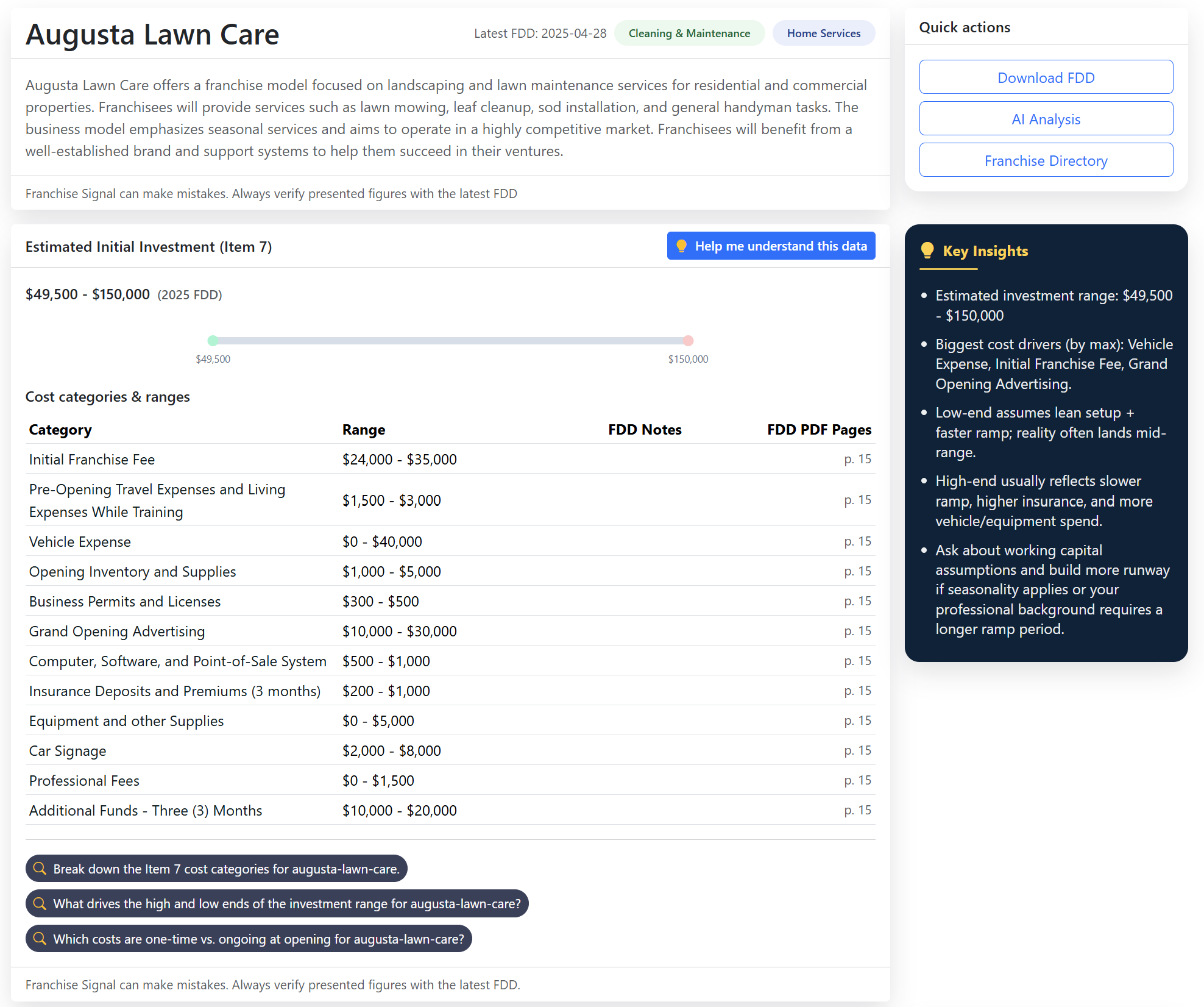

• What does it cost to open Franchise {X}?

• What financial performance claims are disclosed (if any)?

• How many units opened or closed last year?

• What fees and royalties does the system charge?

• How do franchisee and franchisor incentives align?

These documents are typically 100+ pages long and distributed as PDFs. They are dense, unstructured, and vary significantly in formatting, tables, and level of transparency.

The Challenges With Franchise Diligence

Buying a franchise is a six-figure(+) entrepreneurial bet. Yet most research workflows have major friction:

1. Access and Sourcing

Where do you reliably obtain the latest FDDs? Which are current vs outdated?

2. Extraction and Interpretation

How do you quickly pull out investment ranges, fees, Item 19 financials, and outlet growth data?

3. Connecting the Dots

How do Items 7, 19, and 20 interact to form a realistic view of unit economics and risk?

Generative AI has accelerated the extraction problem and tools like ChatGPT can parse PDF data and summarize disclosures. But a key challenge remains:

How do you compare franchises against each other or benchmark a sector as a whole?

That requires structure, normalization, and analytics - beyond just text extraction.

The Missing Layer: Benchmarking, Querying, and Sector Trends

Evaluating a single franchise in isolation is not enough. A meaningful diligence process also needs:

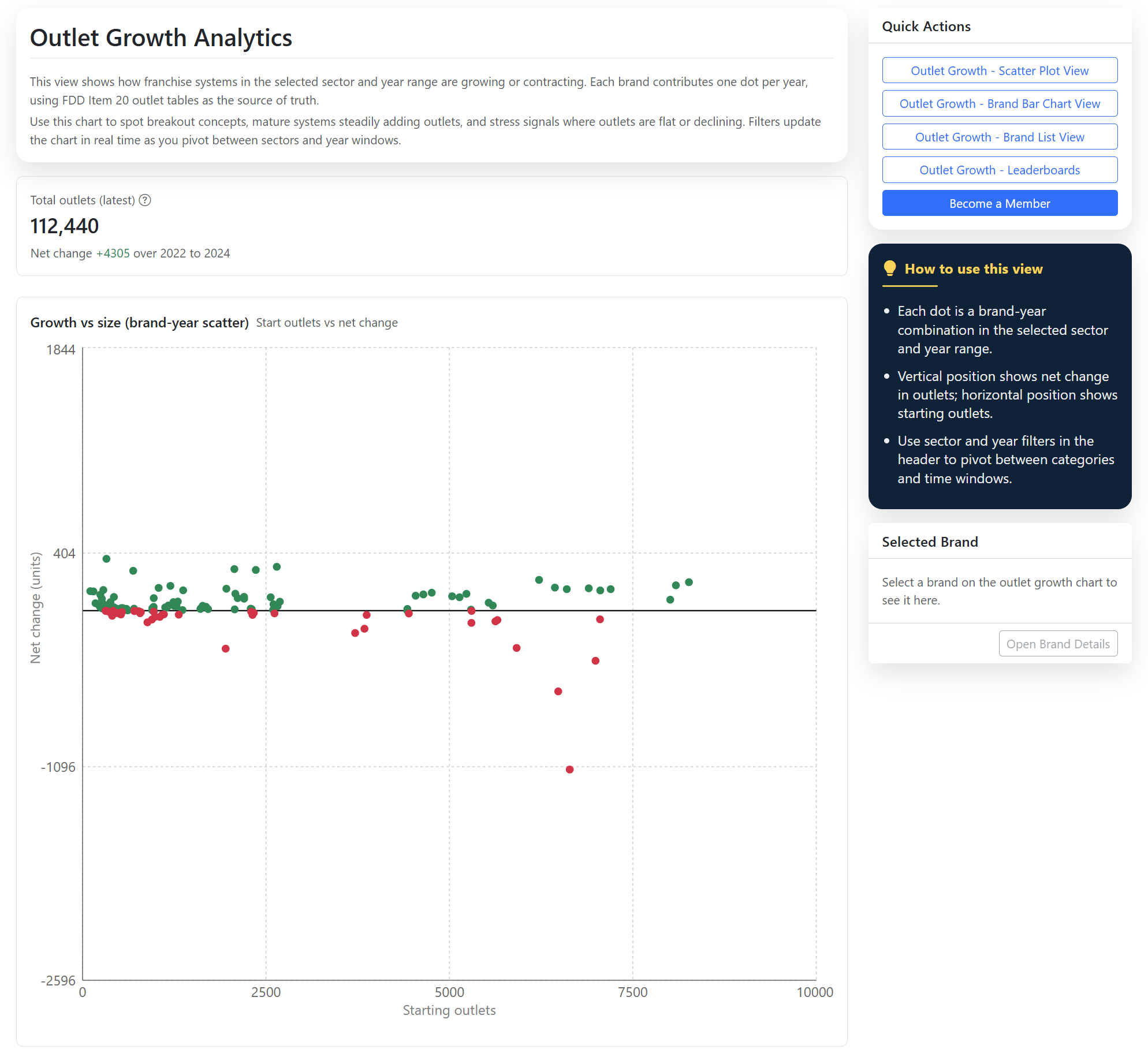

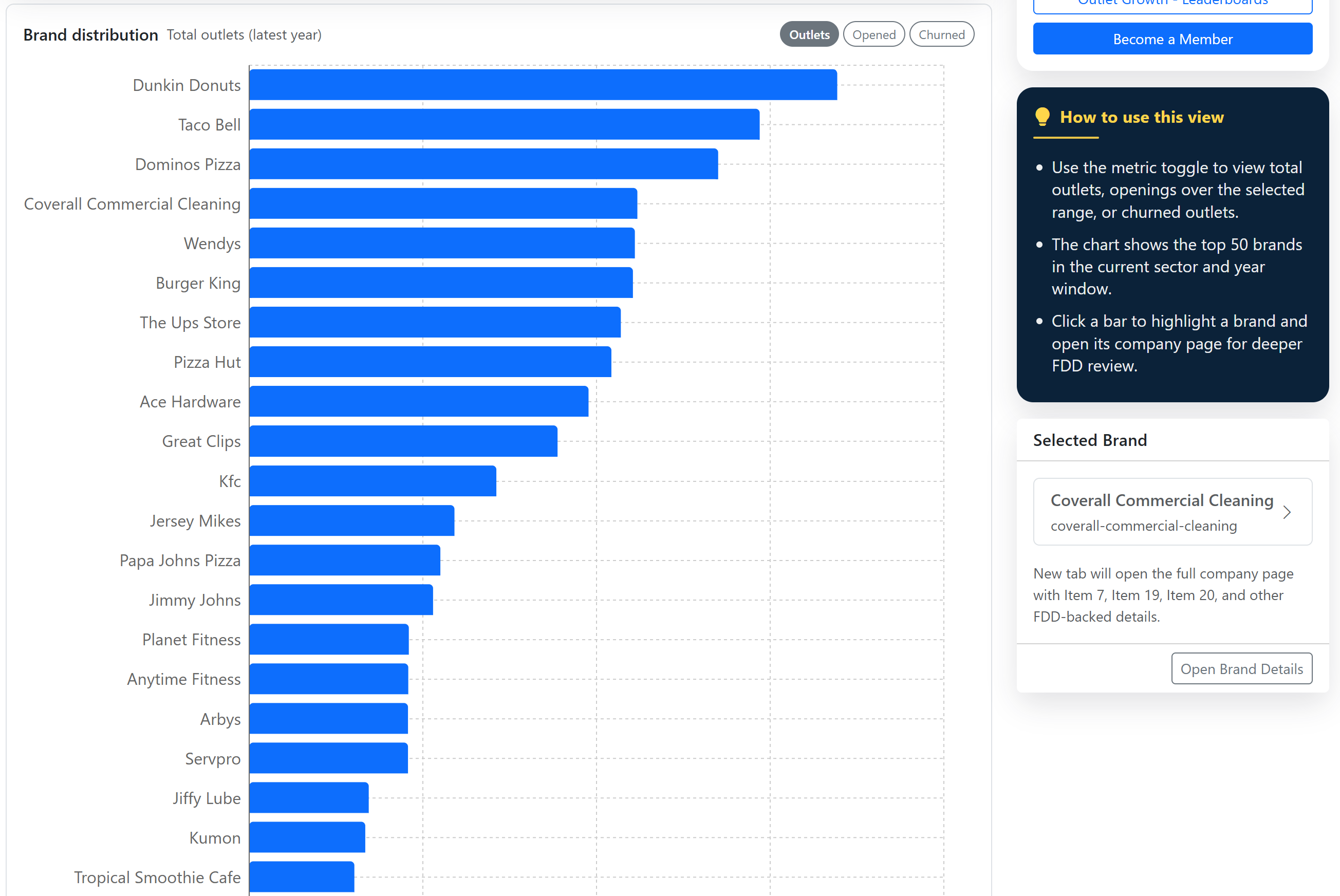

• Cross-brand comparisons

• Sector-level trends

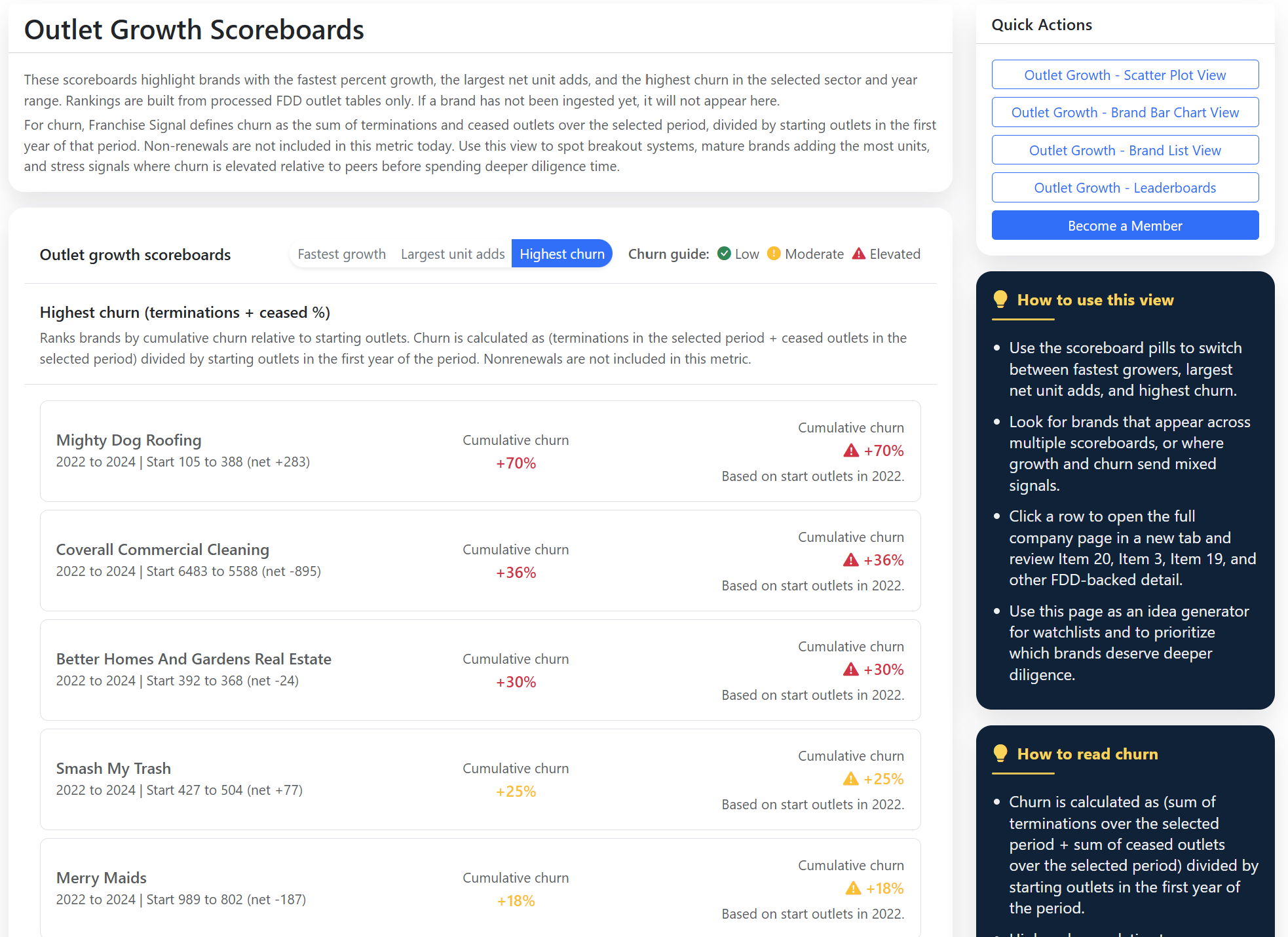

• Outlet growth vs churn data

• Peer benchmarks and outliers

• Emerging brand detection

There is no "centralized data layer" for franchise analytics.

Introducing Franchise Signal

Franchise Signal is a new research, analytics, and diligence platform built to bridge this gap.

The platform acts as an intelligent interface on top of FDD disclosures and unstructured franchise data, allowing users to answer questions:

> How can I quickly compare and query across multiple franchises?

> How does the data fit into broader sector trends?

> How do I benchmark Franchise {X} data and perform top down analysis?

> What questions and research topics should I consider?

The goal is to make franchise research more transparent, data-driven, and efficient - especially for prospective operators, analysts, advisors, and investors who need to quickly evaluate markets and models.

Who Is This For?

Franchise Signal serves multiple stakeholders:

• Prospective franchisees evaluating investments

• Analysts conducting sector research

• Operators seeking peer and competitor benchmarks

• Anyone making decisions involving franchising risk

Franchising today is large, economically important, and information-asymmetric. Transparency reduces risk and leads to better decision-making.

Closing Thoughts

Information and analytics will always be just that - it is a second order derivative and only exists because of the hard work that franchisors, franchisees, operators, and owners put in running businesses every day.

This does not circumvent the need for diligence however - and Franchise Signal brings an additional layer of analytics, benchmarking, and unbiased data to your research and diligence workflows.

If you work with franchise data, are evaluating brands, or face similar challenges extracting value from unstructured documents, I would welcome an opportunity to connect.

Comments ()