Money Fundamentals - Who is to Blame for Inflation?

This article offers a look into the fundamentals of money - it's history, how basic economics work in conjunction with money, how money is created in the United States, and what tools our government (Federal Reserve) has for managing the money supply.

We live in interesting times (cover image credit Photo by Christine Roy on Unsplash). In just the last two years we have seen:

- Inflation in the United States reach an official 6.2% in October 2021

- The United States Federal Debt reach a new all-time high of $28.5 Trillion (also represents a new all time high of 125% our GDP)

- The Federal Reserve increase the United States' money supply more than 37%

- The S&P 500 Index gain more than 40% despite a worldwide pandemic

Along with supply chain constraints, inflation is the latest issue facing Americans, and Elizabeth Warren has suggested that this is the fault of 'greedy businesses' who are gouging consumers.

Wondering why your Thanksgiving groceries cost more this year? It’s because greedy corporations are charging Americans extra just to keep their stock prices high. This is outrageous. https://t.co/ZGhL7c3piR

— Elizabeth Warren (@SenWarren) November 24, 2021

After increasing the money supply 37% since 2020, and with 27% of all money printed in the last two years, Warren and Bernie Sanders are also proposing additional taxes on unrealized gains for the ultra-wealthy.

The road to socialism via inflation:

— Naval (@naval) February 10, 2021

• Print money, crash the reserve currency, destroy savers, and force them into inflated assets.

• Asset inflation leads to inequality. Demonize asset holders and tax the nominal gains, thereby confiscating the real value of the assets.

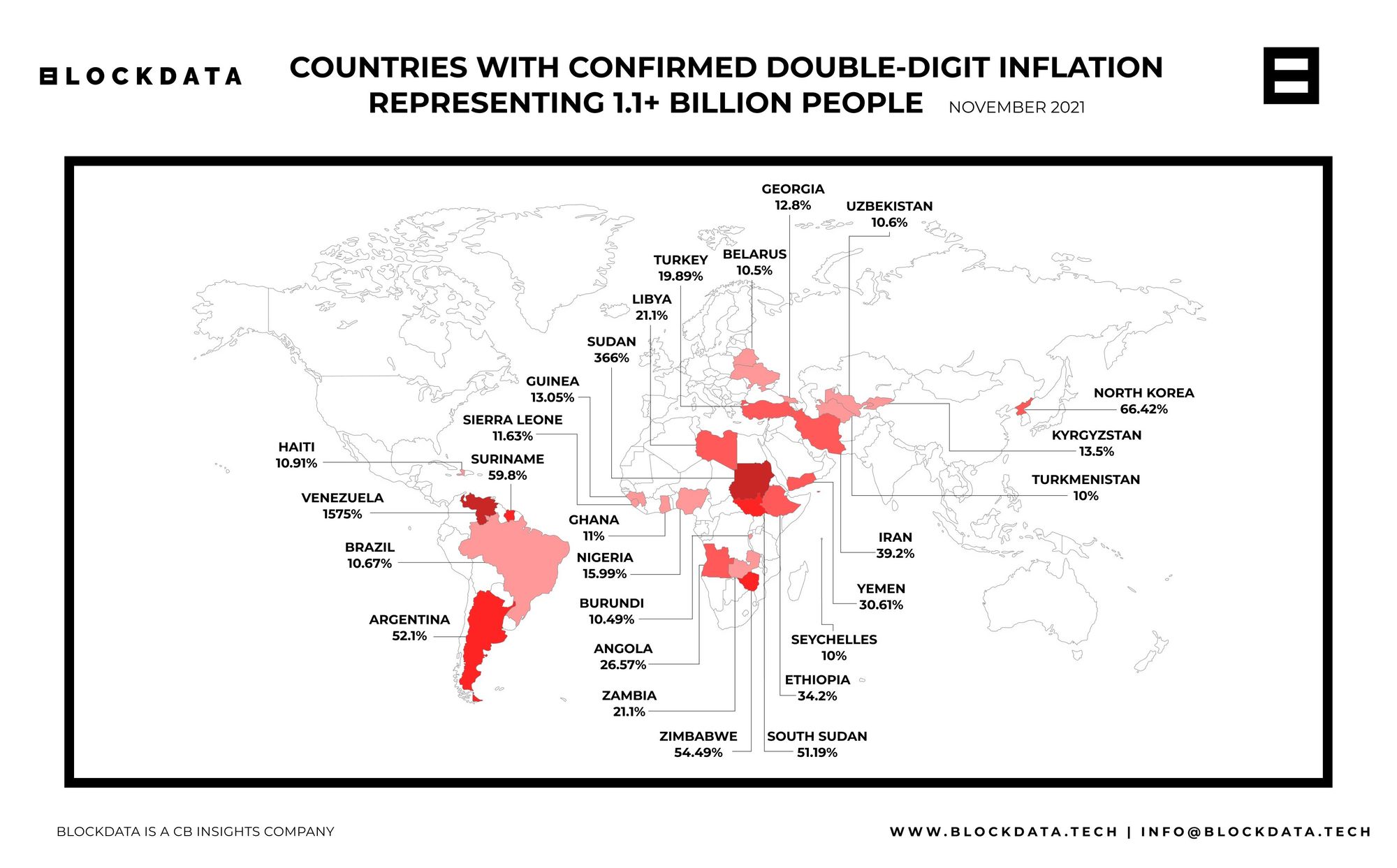

Meanwhile, in the rest of the world:

- 1.1 Billion people live in countries experiencing double digit inflation

- 1.7 Billion adults remain without a bank account (women represent 56% of this total)

- Remittance payments - which act as a lifeline to underdeveloped nations - average more than 6% for fees worldwide in 2021

- The latest inflation rates (38% decline in the purchasing power of the Turkish Lira in the last month) have led to riots in Istanbul

All of these issues raise the question of what is money? And how does it impact our economy (and correlate with our political landscape)? This article offers a look into the fundamentals of money - it's history, how basic economics work in conjunction with money, how money is created in the United States, and what tools our government (Federal Reserve) has for managing the money supply - so that we can begin to answer for ourselves:

- Are the 'greedy' corporations really to blame for inflation right now?

- How does the government control the money supply?

- What kind of hidden taxes (inflation) are present on your savings?

- Are we in a bubble with asset prices?

Part I - History of Money

The history of money is the history of the world - money is intertwined with economics, politics, government, and war. The history of money could be its own book, and there are phenomenal resources that look at money and its history.

Throughout time, money has predominantly served functions as a:

- Medium of exchange

- Unit of account

- Store of value

- Standard for a deferred payment

And again from Wikipedia, money must have properties to serve society, namely:

- Fungibility: its individual units must be capable of mutual substitution (i.e., interchangeability).

- Durability: able to withstand repeated use.

- Divisibility: divisible to small units.

- Portability: easily carried and transported.

- Cognizability: its value must be easily identified.

- Scarcity: its supply in circulation must be limited.

And lastly, money must be somewhat stable - the US dollar has become the world's reserve currency due to its stability. No business or individual wants to engage in transactions with a money that cannot be relied upon or predicted in its future value.

Gold and Silver have a long standing history of acting as a monetary base in some capacity - through physical gold/silver coins or as a promise by a government issuing paper money (that the paper could be redeemed for a certain amount of gold or silver).

- 1792 - Congress passes the Mint and Coinage Act - it authorizes the Bank of the United States to hold its reserves and establishes a fixed conversion of US dollars to gold.

- 1860s - Congress finds it difficult to pay for the Civil War. Congress issues greenbacks, that eventually are set to a fixed conversion rate with gold.

- 1910s - World War I causes many countries to move off the gold standard in order to finance the war (through money printing).

- 1934 - Congress passes the Gold Reserve Act on 30 January 1934; the measure nationalizes all gold by ordering Federal Reserve banks to turn over their supply to the U.S. Treasury in return for gold certificates. The act also authorizes the president to devalue the gold dollar. Under this authority, FDR, on 31 January 1934, devalues the dollar by over 40% (gold is exchanged for less USD).

- 1944 - The Bretton Woods agreement establishes a fixed conversion of USD to gold. Many countries fix the value of their money to the US Dollar, creating another fixed gold exchange rate (only available for central banks).

- 1971 - over the previous decade, France has been redeeming its USD for gold at the fixed exchange rate, thereby reducing US economic influence (it could be argued that gold is more valuable than USD, and with France taking the gold, the US cannot continue to back up all other USD at this rate). Nixon 'temporarily' ends the convertibility of USD to gold.

- 1976 - The US removes all references to gold, and we are officially a fiat only currency.

50 years ago today, on August 15, 1971, President Nixon suspended the convertibility of the US dollar into gold.pic.twitter.com/RUsBLCXGl5

— Documenting Bitcoin 📄 (@DocumentingBTC) August 15, 2021

Even in the United States, one of the most powerful countries, with the world's reserve currency, we see that power and politics have a massive influence over money supply and creation. The rules of the game can change at the whims of politicians' views, should we need to make changes at any time to enhance the United State's standing in the world.

Other countries that don't have the economic power of the US can see their rules of the game change even faster. Just one example - Ecuador's government issuing a 'freeze' on savings accounts in 1999. And we already pointed out above the 1.1 Billion people living in countries with double digit inflation - Turkey just being one of the latest examples.

Even with hindsight of 20/20, economists still disagree on various policies and their impact across the world. Economists have been wrong in the past, and are by no means infallible today - the economy is simply too big to model out in exact terms.

Part II - Money in a Simple Society

To start to get a handle on money, let’s look at money in a simple society. In this society, we will imagine there are four people - a farmer, a carpenter, a tailor, and a toymaker. The farmer grows and sells food, the carpenter makes houses, the tailor makes clothes, and the toymaker...makes toys. In this hypothetical society, we will also imagine that there is a fixed money supply of 1,000 gold coins (denoted here with $), and each person has 250 coins ($) to their name.

Some hypothetical transactions they may make over the course of year 1:

The Carpenter:

-Spends $100 on clothes (from the tailor)

-Spends $100 on food (from the farmer)

-Spends $50 on toys (from the toymaker)

The Farmer:

-Spends $100 on a new barn (from the carpenter)

-Spends $100 on food (from the farmer)

-Spends $50 on toys (from the toymaker)

The Tailor:

-Spends $100 on a new house (from the carpenter)

-Spends $100 on toys (from the toymaker)

-Spends $50 on food (from the farmer)

The Toymaker:

-Spends $100 on food (from the farmer)

-Spends $100 on clothes (from the tailor)

-Spends $50 on a new room in their house (from the carpenter)

At the end of year 1, we have a total of $1,000 in transactions.

- This $1,000 gold coin total of sales of final goods between all parties represents the Gross Domestic Product (GDP)

- The Total Money Supply of this society is $1,000 in gold coins

- Because it turns over once a year, the Velocity of Money ratio is 1

What Happens if Better Technology is Introduced?

In Year 2, by wild inspiration and technology, the toymaker figures out how to make a cellphone. This miraculous feat of engineering now ensures higher efficiency for everyone. The carpenter can more accurately create floor plans, the tailor has accurate measurements, and the farmer can plan crop yields more efficiently - everyone can communicate more efficiently - all because of this miniature phone/computer/app. Naturally everyone wants this new technology so in year two everyone decides to pay whatever money they have saved for a new cell phone.

In year 2, we start with everyone paying $250 of their saved coins to the toymaker for a new cell phone. Now the toymaker has more money and wants to splurge a bit. He hires the carpenter for a new room in the house and pays $500. The carpenter then throws a large party for the town and spends lavishly on new clothes. The tailor in turn buys higher quality crops and food for a feast. In Year 2, with the advent of the cell phone, everyone is now exchanging money more quickly as more high quality goods and efficiency enter the system. In Year 2, suppose we have $2,000 worth of transactions.

This implies a GDP of 2,000 and a velocity of money factor of 2. As we can see, the new technology increased GDP and made the economy better for everyone.

Of course there are limitations to this. At some point there is enough high quality food for everyone, so perhaps the demand for food levels out and prices eventually come down. And if everyone wants a new house, there is a limit on how much that can be supplied immediately, so the price of a house may rise. But with continued ingenuity, the carpenter will incorporate machinery or other technology into his practice and unlock efficiency for everyone and balance supply and demand in a new equilibrium price.

Increasing the Economic Output (and Velocity of Money)

In this way, we can see that even with a fixed money supply, the velocity of money can increase with more technology, and the value that a member of this society receives increases over time. The ‘Pie’ of goods that an amount of money can buy increases over time as technology and process improvements add to the value of society in a deflationary manner.

This is how we evolve from a village of four people with some basic food, shelter, and clothing to a society that has housing, a wide variety of food, sewage, electricity, computers, cars, cell phones, and the like. Of course with more people this becomes more complex, but output is the driving factor of any economy, and increased output is largely dependent on innovation and technology.

To further drive this home, think of today’s society when compared to early medieval days if we still only had 1,000 gold coins in circulation. Those coins would have to change hands many times and could buy a massive amount of goods, even when adjusted per capita for our larger population. The economy is not a zero sum game, but rather is ever expanding as new innovation and markets are unlocked. And with no increase in money supply, the value of the goods you could obtain would increase every year.

Part III - Banking & Credit in a Simple Society

As we saw in the simple economy, the more that innovation and technology improves, the larger the overall ‘pie’ of the economy is, and the more we are able to get with our money. In many cases, that new innovation requires large capital outlays that will pay off after time:

- A new water pipe that will eliminate the need for daily trips to the river

- An oil rig that will provide new strategic petroleum reserves

- A train that will reduce commute times for everyone

- A new school that can educate all of the children

- A new apartment complex that will house many families

- A new shopping center that will offer facilities for many businesses

All of these examples of capital outlays have varying levels of business risk, and some would be taken care of by the government (in a real society). In either case, with good insight and planning, all of these things can be great opportunities to expand the ‘pie’ of the economy and be a net good for driving innovation, technology, and opportunity for everyone.

Enter the world of commercial (or government) lending. Just as we saw in the history of money, banking evolved in primitive societies to help facilitate increased economic growth through credit.

And even with another simple example of our primitive society we can see that extending credit (and taking on debt) can be a way to pull forward and enable economic growth.

Suppose that in our simple society, the tailor has a way to create a new sewing device. The device will cost $300 but will produce 10x the clothes (at a higher quality). The tailor convinces the carpenter, farmer, and toymaker to loan him the money ($100 each) and promises to pay them back one year later at a 10% interest rate ($110 each). The tailor uses the capital to produce the new machine and then is able to create more clothes faster. The tailor produces and sells more clothes, and all clothes are of higher quality. He pays back the others with the profits of his new innovation, pays for other things in the economy with his added money, and all of the others in society now have the ability to get more higher quality clothes - all the while the same money supply is present in the simple society (still 1,000 gold coins). The credit extended (and debt taken) was used to grow the entire economic pie.

Part IV - How is Money Created?

So if the economy keeps growing and everything gets more efficient, why am I able to purchase less over time? *Queue the money printers*

Normal money is actually a bunch of ancient mainframes running cobol in batch mode, where govt can edit money database whenever they want

— Elon Musk (@elonmusk) November 15, 2021

So far all of these examples of GDP, Velocity of Money, Credit/Debt, and the Growth of the Economy have been in a simple society with a fixed and agreed upon supply of money (and no fractional reserve banking). This is helpful to see transactions and concepts in individuality, but of course, a fixed supply of money is *not* how the world works. So in this section we will review how money gets created in today’s real society and explore the other side of the demand and supply equations.

As we saw in the history lesson, the United States abandoned gold conversion in 1971, and our monetary system is now purely a fiat system. This is also true throughout the modern world, as every country operates on a fiat system. Many modern countries also have their own central banks that carry out all fiscal policy (the Federal Reserve in the US, the European Central Bank in the EU, the Bank of England, the Bank of Japan, the Bank of China, etc). Central Banks and Government go hand in hand as fiat money is only good if embraced by people, and governments require that taxes be paid in certain denominated currency, thereby ensuring the market for the currency they create.

This section will focus on the US Federal Reserve and government, but many of the other central banks and governments operate under similar policy.

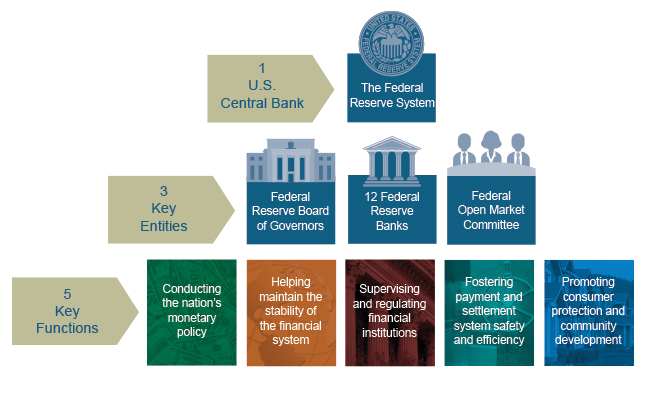

What is a central bank? What is the Federal Reserve?

The Federal Reserve (the Fed) is the United States central bank. It was formed in 1913 and has chartered goals of maximizing employment and keeping consistent low inflation. It does this through monetary policy that we will discuss in detail. The Fed operates “independently” from the government under the governance of 7 presidentially appointed and senate confirmed governors (majority (51) of 100 votes needed for confirmation). Under the structure of the fed operate 12 member banks, who are responsible for overseeing operations in their various regions.

The Fed, through its monetary policy and other tools, also serves as a base layer of sorts for other member banks and chartered financial institutions throughout the United States. So a bank like JP Morgan Chase or Bank of America will abide by all regulations and charters enforced by the Fed and its regional banks.

How does the Federal Government Raise Money?

Before understanding the Fed’s role in creating money it is important to understand how the government raises money. The government can raise money by:

- Collecting Taxes (Personal Income, Corporate Income, Capital Gains, etc) - although complex in detail, we understand the concept that if the government raises or introduces new taxes, it will collect more money.

- Issuing Debt (Bills, Notes, and Bonds) - just as a corporation or individual (as we saw in our simple society) can take a loan, the government issues debt. It does so through three types of debt instruments - short term (less than 1 year), coupon free Treasury Bills (T-Bills), medium term (2-10 year) set coupon Treasury Notes (T-Notes), and long term (20 year+), set coupon Treasury Bonds (T-Bonds).

/investing11-5bfc2b90c9e77c00519aa65f.jpg)

Every week, the government holds auctions - open to the public - where banks, corporations, and other countries will purchase the various forms of debt issued by the Federal Government. The interest rate on this debt is determined in the free market, and we’ll look at some of the metrics used to measure these types of debt later in this article.

It is this government debt that is essential for our economy to function. The last time we had a balanced budget (where the tax revenue brought in could pay for the government spending in the year) in the United States was in 2001. So our government is completely reliant on debt to finance current and future expenditures.

Why is anyone buying debt that won’t be paid back? The United States is often regarded as one of the most trustworthy and stable countries on the planet and has not defaulted on its debt, so other nations and investors continue to hold it with very high stability (AA+ rated by credit agencies). But...everyone also knows that we have the ability to print money to repay our debt - which brings us to the first forms of how money is created.

Money Creation - Option 1 - ‘Printing Money’ (Buying Government Debt)

We see the meme’s but how does money ‘printing’ actually work? How does JPow ‘fire up the printers’?

Yes the government prints new bills and creates new coins - this accounts for some 3-8% of new money issuance. But the vast majority of money is created with the ‘click of a button’ at the Fed. The Fed will purchase the above-mentioned government debt, and a journal entry will add the government bonds to the Fed’s Balance Sheet, and cash to the Government’s balance sheet (and a liability of an IOU to the Fed).

For example, in 2020/2021 the government passed various bills for Covid relief to the tune of 4.2 trillion dollars (Cares Act & American Rescue Plan). To pay for the Covid relief, the government issued debt that was in turn purchased by the Federal Reserve. This ‘money’ came from nowhere - it was created out of thin air by the Federal Reserve and given to the government, and then distributed under the terms of the bill. This process is given the term ‘Quantitative Easing’ - a complicated sounding term and process for ‘printing money out of thin air’.

The graph below is the Federal Reserve’s Balance Sheet. We can see that in 2020/1 its assets grew by $4.5 Trillion as it bought government debt.

And on the flip side, we see the government debt (the amount the government owes to the Fed, corporations, and other countries) increased by about the same.

But if the Fed can print money out of thin air, does this devalue all existing money? Yes and inflation will be covered in further detail below.

Money Creation - Option 2 - Fractional Reserve Banking

One of the important ‘rules’ that the Fed employs is what is known as the Reserve Ratio at commercial banks. The Fed, as part of its operations, oversees all banks and credit institutions and is able to set (and change) the ratio of how much a bank must keep its loans on its books (with the Fed). This reserve ratio ends up being a money multiplier and allows for commercial banks to create credit (which is new money in the system). This process is known as fractional reserve banking and is prevalent throughout the world.

Let’s say the Fed sets the reserve ratio at 10%. So for all deposits a bank holds, they must keep 10% of the cash on hand with the Fed. However, the remaining 90%, they can loan out to other individuals and corporations (with the intent to make a profit). If the bank only keeps the required reserve of 10% ($100) on reserve, they create new money of 10x that amount.

This is somewhat complicated to follow so let’s walk through with an example (ignoring interest payments for simplicity):

- Alice decides to deposit $1,000 at Bank 1.

Bank 1 (Assets: $1,000 cash / Liabilities: $1,000 IOU (to Alice))

Alice (Assets: $1,000 IOU from the bank)

- Bank keeps 10% as reserve and loans $900 to Bob the farmer for new equipment

Bank 1 (Assets: $100 cash, $900 IOU from Bob / Liabilities: $1,000 IOU to Alice)

Alice (Assets: $1,000 IOU from the bank)

Bob (Assets: $900 Cash / Liabilities: $900 IOU to Bank 1)

- Bob the farmer gives the $900 cash loan to John Deere for the new equipment

Bank 1 (Assets: $100 cash, $900 IOU from Bob / Liabilities: $1,000 IOU to Alice)

Alice (Assets: $1,000 IOU from the bank)

Bob (Assets: $900 equipment / Liabilities: $900 IOU to Bank 1)

John Deere (Assets: $900 cash)

- The John Deere Co, now with excess cash after its equipment sale to Bob, deposits its money into its Bank (Bank 2)

Bank 1 (Assets: $100 cash, $900 IOU from Bob / Liabilities: $1,000 IOU to Alice)

Alice (Assets: $1,000 IOU from the bank)

Bob (Assets: $900 equipment / Liabilities: $900 IOU to Bank 1)

John Deere (Assets: $900 IOU from Bank 2)

Bank 2 (Assets: $900 cash / Liabilities: $900 IOU to John Deere)

Bank #2 now has $900 and will loan out $810 (keeping the 10% $90 reserve on its books for this loan) as this process continues.

If we chain together this process, we see *money* of Alice’s $1,000 IOU, John Deere’s $900 IOU, and so forth. In this way the money multiplier can be used to determine fiscal policy impacts from the Fed.

So if the Fed purchases $1 million of government debt from a bank and credits their account with $1 million in newly created 'digital cash', the actual money that makes its way to the economy would be 10x ($10 million) assuming a 10% reserve requirement and that the banks loan out money up to this rate.

It is also worth noting that this Reserve Ratio that the Fed requires for all banks to comply with, was set to *0%* in the wake of Covid and has not yet been increased. While the Fed does have other rules and regulations for banks, this in effect turns over fiat money ‘printing’ power to commercial entities. In effect, if a bank can find a way to deploy capital with any sort of real return, it can simply ‘create’ new money in the form of credit in the markets.

Part V - How Much Money Is There?

To recap the last section, the Fed can increase the money supply by:

- Creating new money and using it to purchase Government issued debt

- Reducing the Reserve Requirement of Banks, which allows them to loan out more of their deposits, creating new money in the form of the money multiplier

In this way, the Fed, through both direct and indirect action, determines how much money is present in society. So how do we measure and track how much ‘money’ there is out there? The Federal Reserve keeps statistics on overall Money Supply broken out by different types of money. These stats are known as:

- M0: this is known as the ‘monetary base’ and refers to Physical paper and coin currency in circulation, plus bank reserves held by the central bank. In effect this is the ‘physical printing of money’

- M1: includes all of M0 and plus the amount of demand deposits, travelers checks and other checkable deposits + most savings accounts. Note that the Fed in 2020 updated M1 to include savings accounts

- M2: includes all of M1 (and M0) plus money market accounts and small certificates of deposit (CD’s)

The stats for all of this money are published by the Fed. We can see that between January 2020 and November 2021 we saw our M2 money supply increase from $15.5 Trillion to $21.2 Trillion - a whopping 37% increase in the money supply in less than two years.

What about stocks, real estate, and crypto - where are they included in the money supply? Most of the definitions of money revolve around the idea of ‘how quickly can this asset be liquidated into immediate ‘cash’? And how ‘sure’ is this asset able to be liquidated? There are *many* different calculations for just how much money is in the system. But for assets such as stocks and real estate, they are not included in any government official definition of the money supply.

For example, if you have $1,000 in your checking account and move it to E*TRADE to purchase a stock, this money eventually is transferred to the seller of that stock who then (presumably) moves the money back into another checking account. So no money is created or lost in the purchase or sale of a security in this example under the monetary base definition. Crypto may eventually play a different role in this, but that is for another analysis and article.

Other Central Banks around the world leverage similar structures for both introducing new money to the market - quantitative easing (money printing) and fractional reserve banking, and they also have similar measures of M0/M1/M2 for tracking the money supply.

Part VI - Inflation (and Deflation)

So what happens if the Fed prints too much money, or commercial banks lend too much (with zero reserve requirements)?

This is inflation, and occurs when more money is chasing the same amount of goods or output. Back to our simple society, if overnight we gave everyone an extra 250 gold coins and doubled the money supply, we would expect that the cost of goods (and other assets) would rise by that same factor.

If we look at our definitions of money, recent fiscal policy, and our rising costs of goods, we can see we are in a similar place of inflationary concern. Since 2020, the M2 money supply has increased by 37%. And official inflation rates are at 6.1% (as of October 2021).

How does the government track inflation? How is inflation measured?

Prices are collected each month in 75 urban areas across the country from about 6,000 housing units and approximately 22,000 retail establishments (department stores, supermarkets, hospitals, filling stations, and other types of stores and service establishments). All taxes directly associated with the purchase and use of items are included in the index. Prices of fuels and a few other items are obtained every month in all 75 locations. Prices of most other commodities and services are collected every month in the three largest geographic areas and every other month in other areas. Prices of most goods and services are obtained by personal visits or telephone calls by the Bureau’s trained representatives. In calculating the index, price changes for the various items in each location are aggregated using weights, which represent their importance in the spending of the appropriate population group.

Taking a look at the October 2021 report, we see an overall annual increase of 6.1% in the process of all goods.

Over time, we see relatively consistent inflation of ~3%, meaning that every year the purchasing power of $1 is reduced to $0.97.

Who Benefits from Inflation?

Anyone who is holding debt benefits from inflation. If you take out a loan for $1,000 and have to pay it back next year at 10% ($1,100), then inflation helps you as the next year the amount to be repaid is ‘worth’ less. And who did we see has $28.5 trillion in debt? (ahh yes the government)

Likewise, asset holders (i.e. those with real estate, stock, or other commodities) will presumably be the same the next year - real estate will rise in value, companies adjust prices and pass on inflationary costs to consumers, and commodities (as we saw with the simplified society) rise in price since more money is chasing the same goods.

Who Loses in Inflation?

Anyone holding cash loses purchasing power every year as inflation deters saving money in the form of cash. And anyone without assets also loses as the money they make now does not go as far. The $1 loaf of bread now costs $1.06.

What would happen in a society without inflation (deflation)?

This is a very interesting topic and one that will be explored in further detail in another article. Technology by nature is deflationary (we get more bang for our buck with every advancement).

Now we believe that three sources of deflation will overcome the supply chain-induced inflation that is wreaking havoc on the global economy. Two sources are secular, or long term, and one is cyclical. Technologically enabled innovation is deflationary and the most potent source.

— Cathie Wood (@CathieDWood) October 25, 2021

One problem with fixing the money supply and having deflation is that people may begin to hoard money, as purchasing power would go *up* over time. This could reduce the amount of money available to be lent out as credit, which pulls forward innovation. Furthermore, any debt holders would have to pay *more* over time. The government today has 28.5 trillion in debt so our official currency won’t purposely be deflationary any time soon - but the idea of deflationary (or fixed) currency would theoretically accrue the value of innovation to those who hold the money supply.

Part VII - Monetary Policy and Tools

So if inflation reduces purchasing power and is especially regressive towards those with lower (or no) saved assets, how does the Fed ensure we don’t have runaway inflation?

- The first (and most obvious answer) would be to *not* put more money into circulation. Taken one step further, the Fed can reduce the money in circulation by selling government debt into the public market. This takes money out of circulation and puts it on the Fed’s balance sheet as an asset (cash).

- The second option is to increase the banking reserve requirement (to reduce the money multiplier)

Federal Funds Rate

One other very important and followed metric is known as the Federal Funds Rate.

/pensive-african-american-woman-lost-in-thoughts-using-cellphone-1201492868-27ef61094667438b8ae80415a48a832c.jpg)

The Federal reserve pays interest (known as the Interest on Reserve Balances (IORB)). Although currently the reserve requirement is zero, the Fed will still pay banks a certain interest rate for any of their holdings that are kept with the Fed. In times of reserve requirements, banks will also loan each other money overnight to ensure they all meet their reserve ratio.

The Fed controls this interest in reserve balance, which becomes the effective Federal Funds Rate. So when the WSJ or others talk about the Fed increasing the interest rate, this is what they refer to.

And this interest rate has broad implications for everything from home loans to business loans. If a bank can receive a 3% interest rate on any balance they keep with the Fed, they will require at least that much in return when loaning it out. No bank will give a 2% interest rate mortgage when the Fed pays a higher 3% rate. Likewise, the startup that needs a loan will have to pay a higher risk premium when the bank is getting free money.

Open Market Operations

All of these tools that the Fed uses to manage the money supply (and try to ensure we don’t have high inflation or unemployment) are referred to as Open Market Operations, and the Fed meets every six weeks to review interest rates, and enact any policy changes (like raising rates).

One thing that is *very* interesting to note is that although the Fed can increase interest rates or restrict its ‘money printing’ of buying government debt, this can also hinder the government's ability to operate.

If reserve requirements or the federal funds rate increases, then the government will also have to ‘entice’ prospective buyers of its future debt. Buyers will want higher interest rates paid on their government bonds because they can get more money for ‘free’ from the Fed for not buying anything. In addition, when inflation is higher, the government benefits as it can more easily pay the coupon payments and interest in all of the long term debt it has issued. When inflation decreases, those interest payments represent a higher ‘real’ money rate.

The Fed has put us in a catch-22 as any failure to raise interest rates will undoubtedly ensure that high inflation continues. But raising rates and curtailing free money printing and purchase of government debt requires the government to pay an ever larger portion of the money it never has to service the interest on its already massively increasing federal debt.

Don’t worry, articles on bitcoin are coming soon enough :)

Part VIII - Money and Macro Insights and Valuations

Right now we are at some of the most interesting points in history. Never before in the Fed’s history have we seen a ‘zero’ reserve ratio, ‘zero’ federal funds rate, massive quantitative easing (free money printing), and high inflation all at once like this.

Is the Stock Market overvalued?

The S&P 500 is up ~40% since the start of 2000, which is roughly in line with the increase in money supply over that same time. While P/E multiples may be historically high, this may also be that the largest tech companies make up 40%+ of the index, and exponential change in tech (and its growing multiples) may become more of a norm.

Are corporations being greedy as claimed by Elizabeth Warren?

Corporations (Banks) and their greed and excess largely contributed to the earlier crash in 2008 (bailed out by Fed). And of course specific elements of greed could be pulled out as corporations by law exist to serve their shareholders. But with a 37% increase in the money supply, and official inflation at 6.2% it is inaccurate to claim that the increase in prices facing Americans are due to 'corporate greed'. Furthermore, to demonize the same corporations that have jumped through hoops and lockdowns throughout the last two years to keep their businesses running (which provide us with energy, electricity, food, shelter, etc) is not a good look. It is the senate who approves the members of the Fed, and it is the senate who approves trillions of dollars in spending (that the government cannot pay for). The first rule of economics is scarcity, and many politicians seem to disregard this lately.

What about Bernie Sanders and his plan for unrealized capital gains taxes?

It is important to see what drives an economy forward - new jobs, technology, and innovation make the economic pie bigger for all of us. Much of the stock market gains the last two years are a direct correlation with the money supply inflation. Without going into the massive list of reasons this policy would be a disaster, we should be seeking to reward innovators and risk takers who enable such technological innovation - and not introduce some sort of obscure penalty which is theft of assets, much of which is self inflicted by the government's own money printing schemes anyway. Before looking for more money, the government should take stock of what it has - and reflect on the fact that it just printed $4.5 trillion (that devalued all of our money - worldwide - in an especially regressive way).

Will inflation continue?

IMHO, yes. The Fed has not yet announced any plans to taper or raise interest rates. And it is hard to imagine that the Fed would ever sell US Debt anytime soon to actively reduce the money supply, so the inflation we have seen is now the new baseline moving forward. Just as interesting to watch is the Velocity of Money, which is at all time lows (1.1 vs 1.5's of past).

If we assume that a good portion of this low velocity is due to consumers not spending during the pandemic (not going on trips, not buying gas on commutes, not going to social events), then when the velocity eventually returns to a 1.5x, GDP will appear to jump some 30% (assuming no more new money). But if we assume that 'real' GDP grows ~3-5% then the only explanation for the increase in GDP would again be higher inflation on the way.

- Current GDP = $23 Trillion = Money Supply ($21 Trillion) x 1.1 (Velocity)

- Future GDP? = $21 Trillion (Money Supply) x 1.5 (Return to Higher Velocity) = 31.5 Trillion (37% increase)

How does this end?

The issue of rising government debt, free printing, and inflation cannot continue at its current rate. When we devalue our currency, we also devalue the currency of other nations who also rely on the US dollar as their currency (many of whom are not nearly as developed as nations). Inflation is the most regressive tax for our citizens, and everyone else who uses the US Dollar.

We can expect some level of central bank intervention for all of the good things they provide (FDIC guarantees, regulation among banks, lender of last resort, and price stability to ensure a non deflationary currency). And some level of inflation is expected to help facilitate debt and credit, but continued debt sets us on a path to losing world economic power, and eventually losing status as world's reserve currency.

What about Bitcoin?

The idea of putting process over people, aligning incentives, and having a decentralized store of value that cannot be changed by the government will become one of the most important check-and-balance mechanisms our society has. Bitcoin could soon act as the world's reserve currency. More to come on these thoughts in a future article.

Conclusion

Money is complicated. And there is so much history and politics involved. But understanding some of the basics and rules of the current game is critical to appreciate the good and the bad of the current system as new technologies and innovation come along, and help provide frameworks for decisions, valuations, and new ideas.

Be sure to subscribe to the Exponential Layers newsletter and YouTube channel to get all updates on new videos and articles.

Comments ()