Does Bitcoin Actually Solve a Problem?

Before we can evaluate if and how Bitcoin is worth any value, we must first acknowledge and agree that there are problems worth solving.

It has been a rough month for Bitcoin and the overall stock market. The S&P 500 is down 16% since March, the Nasdaq down 22% in the same period, and Bitcoin has fallen from its November high of $68k all the way to $28k. Crypto projects have been failing fast - the stable coins turned out to not be stable, and everyone is out to dunk on crypto as a whole. It’s not a good look for DeFi when the industry that was formed to replace traditional finance is attempting to quickly centralize and raise stability funding, and the market has dragged down Bitcoin with these projects and the broader market selloff.

Throughout the downturn, the internet has stayed undefeated and we at least have some ‘top in hindsight’ memes as stock prices come back to earth and the market quickly pivots to valuing cash flow and profits.

Bitcoin in particular has never shied away from heavy criticism, and with a 24% draw down in the last month, Peter Schiff has had a field day and the WSJ and comment sections are back to dismissing bitcoin as tulip mania.

- “Bitcoin is rat poison” - Warren Buffet

- “Shadowy super coders” - Elizabeth Warren

- “Destabilizing nations” - Hillary Clinton

- “Bitcoin, it just seems like a scam” - Donald Trump

- “I personally think Bitcoin is worthless” - Jamie Dimon

- “A Ponzi Scheme”, “Waste of Energy”, “It has no cash flows” …

Now nearly four years old, Nic Carter’s excellent piece (and 12 sided die) with common Bitcoin FUD eloquently captures all of this skepticism, and as we head into what looks like a recession, the FUD dice continue to be rolled on a daily basis.

Any sarcasm aside, however, it is valuable to revisit any investment thesis in a downturn, and as someone invested in and building on bitcoin (my new lightning network explorer is here), it is a good idea to go back to basics and revisit the ‘why’ and original conviction for Bitcoin.

The first step to identifying any potential value that Bitcoin provides, is agreeing on and acknowledging that there are problems to be solved. If no one thinks there are any problems with the status quo, Bitcoin will always be a ‘waste of energy’ and a ‘ponzi scheme’.

In this spirit, we will take a step back and in this article we will pose four fundamental questions that can help reconfirm the ‘why’ behind Bitcoin (or any other solution for that matter) so that we can then better address the ‘how’ and valuations.

#1 - Does having a form of money solve a problem?

The concept of money is nothing new and has been around since nearly ~5,000 BCE when the ancient Mesopotamians introduced the shekel as currency.

In his book, The Bitcoin Standard, Saifedean Ammous offers rich insight into how the early inhabitants of Yap island used the Rai stone as a form of money.

Whatever the historical medium has been- shells, gold coins, rocks – having a form of money reduces the need for market-making and everyday bartering. We can’t barter all day long, and we can’t horde commodities in our garages to store our earnings.

With this thought, we see the functions of a useful money then as a medium of exchange, a measure of value, a standard for deferred payment, and a store of value. Money must also have properties of fungibility, durability, divisibility, portability, and scarcity.

Money is ingrained in every part of society, and with money that most closely resembles the properties above to satisfy the associated problems, we can acknowledge many of the benefits it provides and problems it solves.

(For anyone who wants a more in depth look at ‘what is money’, it’s history, and its relation to capital allocation, I’ve created this YouTube video that goes into much more detail)

#2 - Do payment networks solve a problem?

The ‘medium of exchange’ function of money has evolved over the years with technology. We may have used coins or bills in the past, but today, ecommerce represents 13.2% of all purchases.

Total US Retail Sales totaled $5.5 trillion in 2021, and US Ecommerce Retail Sales grew more than 31% in 2020, totaling $762 Billion.

Visa, Mastercard, and Paypal have capitalized on this payment infrastructure (digital and in person) with 2021 revenues of $24.1 Billion, $23.6 Billion and $25.4 Billion respectively. Visa and Mastercard combined to facilitate ~70% of card transactions in 2021.

With these sorts of numbers, it is fair to say payment networks solve a problem.

We can even go one step further and talk about the ~3% fees that these networks charge, or the worldwide average ~6% remittance fees. There are many more problems to solve here, but we’ll save that for another day. For now, we can confidently say that with Visa processing up to 24,000 transactions per second - there is inherent value and problems being solved in the payments space.

#3 - Does fiat money have problems?

These first two points are (hopefully) easy to agree on, in that #1 - we need a form of money, and #2 - payment networks facilitate the exchange and transmission of money, which provides value to society.

But what form does (and should) our money take? We looked at early forms of shells and coins. And up until 1971, the US money system was backed by gold.

Today, in the US and around the world, money is a fiat system, with no underlying commodities backing our monetary systems. Is this a problem?

Is fiat money the best form of money that we should use to preserve the efforts associated with our labor? Does fiat best represent the monetary properties we look for in a form of currency?

To best understand the problems of fiat money, it helps to understand the who/how/why of money creation, so let’s take a step back towards basics…

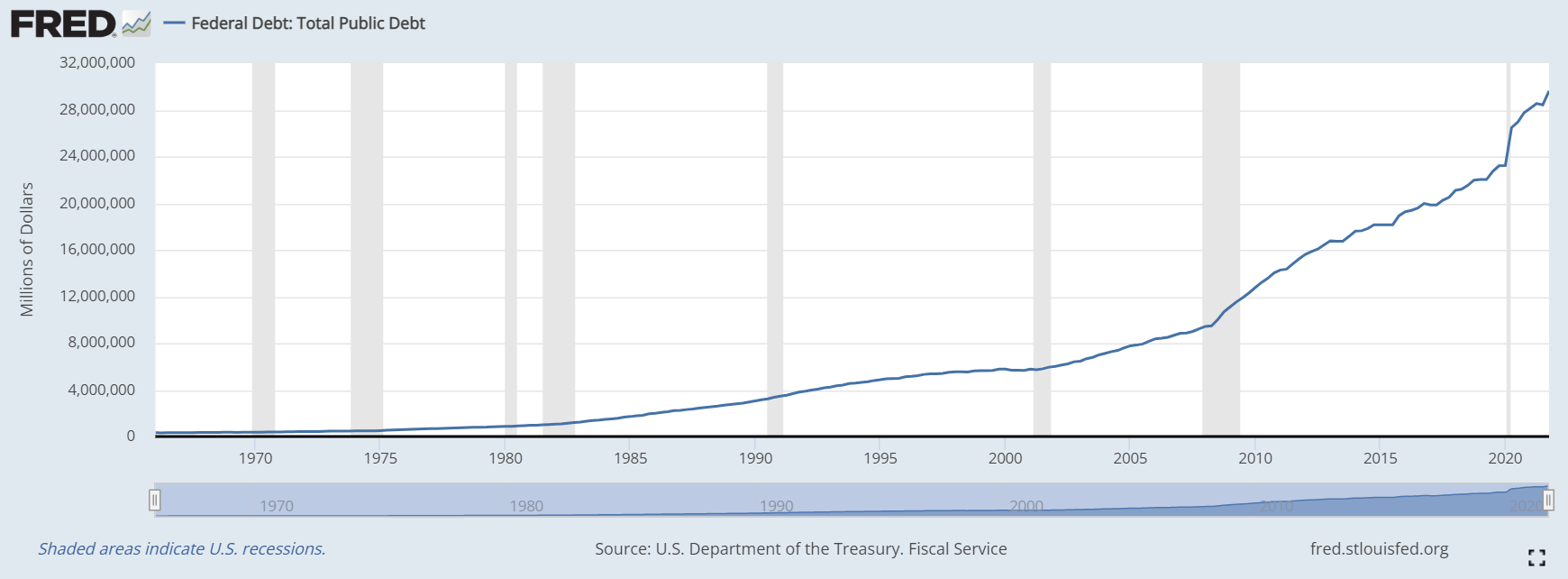

The (US) Government raises money in two ways: (1) Collecting taxes (personal income, corporate, capital gains, etc) and (2) Issuing Debt (IOUs) via T-Bills, T-Notes, and T-Bonds.

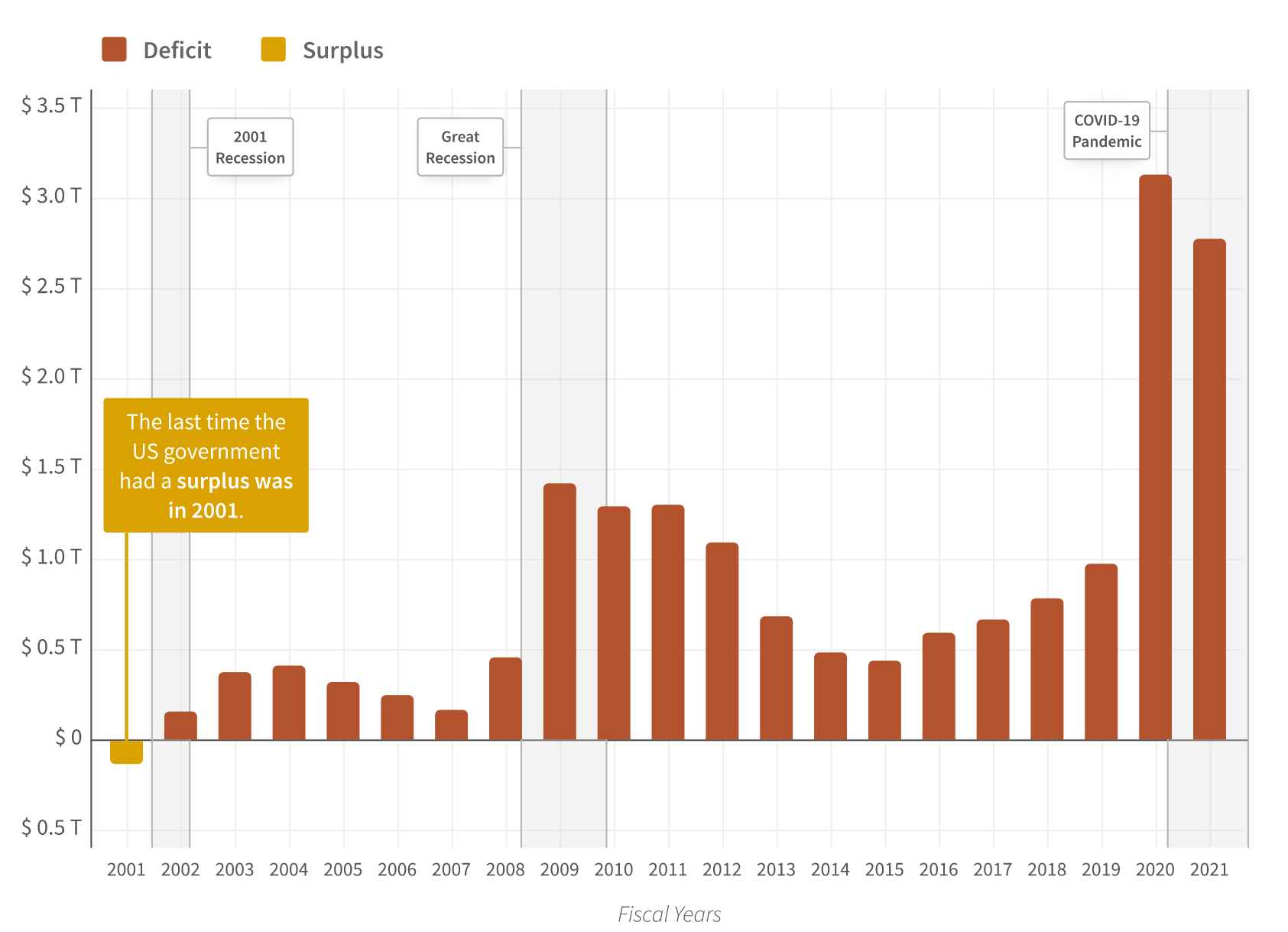

We haven’t had a balanced budget since 2001, and as such we commonly rely on debt to fund government operations.

Anyone can purchase US Government debt, and auctions take place weekly allowing individuals, corporations, and countries to all purchase our debt. In many ways this debt is good - it pulls forward investment activity and when the funds are used to grow output and the overall economic output, which is a win for everyone.

But that’s not where the story ends… one of the largest purchasers of US Government debt is the Federal Reserve. And it is ‘how’ the Fed purchases this debt that is problematic. The Fed obscures this process through complicated terms of ‘quantitative easing’ but what it really boils down to is they click a few buttons and digitally create (or physically print) new money.

The Fed then sends this new money to the government in exchange for the IOUs (T-Bills, T-Notes, T-Bonds).

So for example, when the US Government passed legislation for $4.2 trillion of spending in the CARES act and Covid relief programs, we see an asset (in the form of an IOU) added to the Fed’s balance sheet, and an asset of new cash and corresponding IOU as a liability on the government’s balance sheet.

Is all of this a problem? Should the 7 member Federal Reserve Board be able to issue $4 trillion of brand new money into existence at will?

This isn’t all. Commercial banks also create money at will through our fractional reserve banking system. The Fed sets the reserve rate (how much of a bank’s deposits must be on reserve with the Fed) and the federal funds rate (which translates to the percent commercial banks receive for deposits with the Fed), all of which get passed onto consumers and businesses in the form of loans, mortgage rates, etc.

When the Fed sets a reserve rate of 0% like it did throughout Covid, the Fed has effectively given commercial banks the ability to create unlimited money.

All of this money in the system is measured in the M2 totals, which have increased to match all of the Fed’s money creation rates. In just the past two years, the money supply has increased more than $6 trillion - a 37% increase.

Yikes... https://t.co/E90Lidl8p7

— Senator Cynthia Lummis (@SenLummis) September 10, 2021

So back to the question…is this fiat money standard a problem? Is this the best we can do as a society to offer mechanisms for preserving wealth over time? If Bitcoin is a ‘ponzi’ or ‘rat poison’, I hesitate to speculate on what our current fiat system represents...

If you’re still not convinced this is a problem, we only need to turn back the clock a few times in the past century to see where government and Fed intervention devalued our currency.

- In 1934, FDR signed the gold reserve act into law and then overnight devalued the US dollar by 40%

- In 1971, President Nixon ‘temporarily’ ended the convertibility of USD to gold. This transitory measure became permanent, and just five years later all references of convertibility of gold to USD were removed.

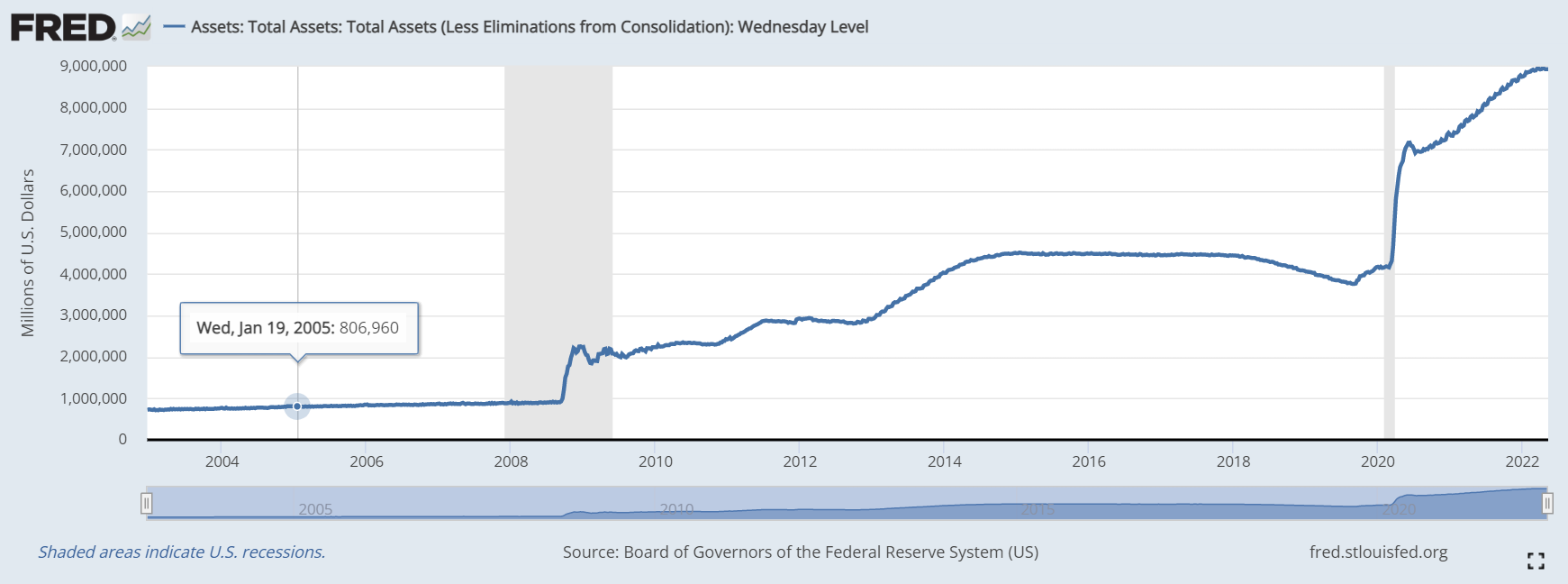

And over the last 20 years we see spikes and continued run up in the Fed’s balance sheet - from less than $1 Trillion in 2002, to now nearly $9 Trillion in 2022. This ~12% CAGR easily outpaces the S&P 500 returns over the same period.

The devaluation of fiat money is not a one-time in history. It is standard operating procedure. And with our current political system’s incentive structure, it is in no one’s best interest to make sure that we balance our budget when we have the option to simply kick the can down the road.

(There is a lot to unpack in how money is created, and I’ve created this video to go into additional detail).

#4 - Is Inflation a Problem? Is inflation a result of money creation?

It was supposed to be “transitory”, but now inflation has become the talking point of the last year. Just this last week Jeff Bezos and Elon Musk both (in seeming agreement) tweeted about the negative effects all of our money printing has had on inflation - pushing back on narratives from the Biden administration, Senator Warren, and others who have long promoted narratives that everything is Putin’s fault - or better yet “corporate greed”.

There is no denying inflation. CPI is officially at 8.3% in the US and we can see firsthand price increases across the board. A dollar today has the purchasing power of $26 in 1913. And inflation is the most regressive tax on society. Historically we have taken a lack of inflation for granted in the US, but more than 1.1 Billion people live in countries with double digit inflation (and 1.7 Billion adults remain without access too a bank account).

The saddest image I've ever made I think. We need a #Bitcoin standard yesterday. pic.twitter.com/xibCbTjNbO

— Sam Wouters (@SDWouters) November 24, 2021

But is inflation a direct result of money creation?

For all the talk about how Putin is responsible, CPI has been above 5% since May of 2021.

As for “corporate greed” at the grocery stores, we can just look to Target’s 52% drop in first quarter profit this week and stock drop of more than 25% following their latest disappointing quarterly earnings.

Are there supply and demand issues at play causing increased prices? Of course. And Cathie Wood has some good points about potential deflation coming due to higher inventory levels. But the $6 trillion new dollars we put into circulation over the past two years is more than 15x Saudi Aramco’s entire 2021 revenue.

Velocity of Money is at all time lows (1.1 vs 1.5's of past). If we assume that a good portion of this low velocity is due to consumers not spending during the pandemic (not going on trips, not buying gas on commutes, not going to social events), then if the velocity eventually returns to a 1.5x, GDP will appear to jump some 30% (assuming no more new money). If we assume that real GDP grows ~3-5% then the only explanation for the increase in GDP would again be continued higher inflation.

We all recognize that printing and giving every person a million dollars would result in inflation. So when we create $6 trillion dollars in such a short time frame, we have to expect some level of inflation.

Conclusion - Is Bitcoin the Answer?

We have outlined four problems and premises:

Money as a function has value (we need to be able to exchange goods and store value across time).

Payment Networks have value (we need to be able to transmit value across space and time).

Fiat money has problems - most notably that it is inherently inflationary, devalued every year, and the rules of the game are changed at the whims of a 7 member board of governors.

Inflation is caused by money printing and is detrimental to society. It is an invisible tax on those without assets, it centralizes power in the hands of a few (central bankers), and it subverts democracy when we can print money at will rather than make hard decisions on raising the money via taxes.

If we can agree that these are indeed problems, we can begin to look at the merits, specifics, and valuation metrics of Bitcoin, or any other possible alternative that could plug into these problems/solutions. Of course that becomes a more nuanced discussion, and I’ll work to get some more articles on that in the future.

I would love to hear your input on any of these points - please feel free to connect with me on Twitter. As full disclosure I am long Bitcoin, so I welcome any counterpoints that would revoke my theses.

I’m also building analytics for the Bitcoin Lightning network. You can browse all details of the Lightning Network in this explorer, and would I love to get in touch with you if you are currently or interested in running a node or would like overall lightning network data ⚡🙏

Comments ()