Microsoft - Strong Segment Growth and a 25% Upside in 2023 Price Target

Every day, all around the globe - concrete is poured, data centers are built, and servers are unloaded, racked, and networked into an ever growing mesh of compute and storage services. It is truly where the physical meets the digital, and the moat for the public cloud vendors is deep and growing.

The Public Cloud as a Base Layer

It’s no secret that “software is eating the world.” But just how much of the world is it eating?

Robert Smith founded Vista Equity Partners in 2000 and has grown Vista’s portfolio to include more than 80 enterprise software, data and technology-enabled companies - a $95 billion portfolio of assets under management, and a list of companies that employs 90,000 people worldwide.

In his recent podcast conversation with Patrick O'Shaughnessy (Invest Like the Best) he highlighted an incredible statistic:

“The average ROI of the products that we sell to our average customer is 640% [ROI]”.

“Think about we have 80-plus software companies, 300 million users of our software over, I think, it's now 2.2 million customers, I think 800,000-plus enterprise, 1.4 million small to medium businesses. But we look for what is the value of the software that we're selling.”

Another hypergrowth success story is Snowflake - revenues have grown from $265 million (FY 2019), to $592 million (FY 2020), to $1.2 billion (FY 2021). Unlocking siloed data across the enterprise continues to drive productivity, and Snowflake counts 241 of the Fortune 500 as customers.

In these examples, we see thematic trends:

- The software companies digitizing B2B workflows and entire industries drive productivity increases and ROI (no surprise).

- B2B SaaS companies have high baked in growth expectations ($MSFT Price/Sales: 8.9, $ADBE P/S: 9.0, $WDAY P/S: 7.0, $TEAM P/S: 11.0)

- The public cloud is the foundational base layer for nearly all of these companies - their success and company foundation is all an abstraction layer built on top of the Cloud - which as we will dig into offers a 30%+ operating margin to Microsoft.

Just How Big is the Cloud Opportunity?

Has all of the growth in cloud (and SaaS) already played out? Is the upside already baked into the hyperscaler cloud play?

- Data Volume is growing exponentially - The IDC Estimates that by 2025, world data volume creation will reach 175 Zettabytes (from 33 Zettabytes in 2018). If you could store all of that data on DVD’s - that stack of DVD’s would circle the earth 222 times.

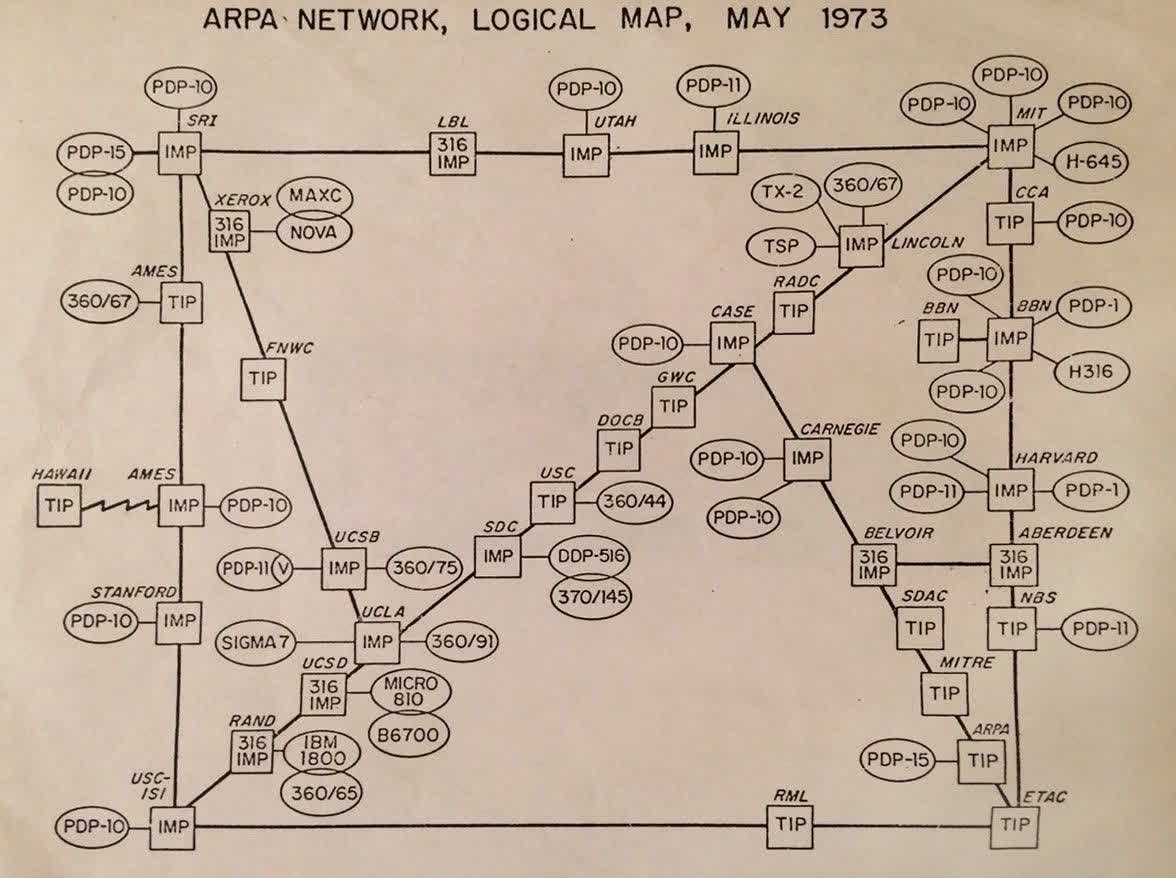

- Internet Connected Device Growth - In 1973, we saw 4 connected devices make up the original ARPANET. Less than 50 years later, we see more than 22 billion connected devices, with an anticipated 50 billion devices online in 2030.

ARPANET circa 1973 (Wikipedia)

- Accelerating Internet Bandwidth - The early Ethernet cables of 1983 could transfer ~3 Megabits per second. Today, ethernet cables can transfer data at speeds of ~400 Gigabits per second. This is a 100,000x improvement in less than 40 years. (For reference, 1 gigabyte is roughly equivalent to the amount of data in your favorite half hour Netflix show.)

One scale point to highlight the staggering size and growth of the cloud:

AWS's Identity and Access Management (IAM) Service - which handles calls from every customer to every service across every region - routinely handles 500 million API Calls every second.

More broadly, we see continued exponential growth in internet access, usage, and consumption of digital media:

- In 20 years, we have seen more than 7x growth in the number of connected users, and now more than half the planet has access to the internet.

- We spend an average of more than 6 hours a day interacting with digital media (on the internet) - up more than 100% from 2008.

And if these growth trends aren’t enough we can again look to the metrics for productivity:

- Corporate data stored in the cloud is expected to grow from 42% to 54% over the next 5 years.

- Cloud operations - and migration - offer a proven ROI. AWS and IDC’s research on this front highlight 637% ROI over 5 years.

In 2015, AWS added enough server capacity to support a Fortune 500 enterprise every single day.

Today, AWS has 30 Data Center Regions (and 15 more announced) and 96 Availability Zones. Microsoft has 60+ announced Data Center regions, including its foray into space.

Every day, all around the globe - concrete is poured, data centers are built, and servers are unloaded, racked, and networked into an ever growing mesh of compute and storage services. It is truly where the physical meets the digital, and the moat for the public cloud vendors is deep and growing.

Microsoft - Capitalizing on Cloud Computing

How can we then capitalize on this cloud base layer? With AWS as the current cloud leader (and a fantastic company), here are four reasons why $MSFT is a stronger investment opportunity:

1) 22% Cloud Market Share and Growing

Amazon (AWS) is the leader with ~34% of the overall cloud market, which could hit $1 Trillion in revenue by 2027. Microsoft’s share of this market has grown to 22% over the past 5 years, and is poised for more relative growth especially as Amazon makes its way into so many of its competitors' businesses.

We also don’t need to wait for Microsoft to “prove out” its business model. Unlike Google Cloud Platform (GCP), Microsoft's Azure is highly profitable with 30%+ operating margins. The growth of the cloud translates directly into a growth in Microsoft earnings.

2) AI and Cloud Integration Among Business Lines

“We are building a distributed computing fabric – across cloud and the edge – to help every organization build, run, and manage mission critical workloads anywhere” - Microsoft 2022 10K

Every line of Microsoft's business is oriented towards this theme.

- Windows continues to offer the operating system of every networked computer.

- XBox, and the PC/tablet products and segments offer an input to this global compute mesh.

- Gaming and the LinkedIn segments are metaverses of their own - at some point human time and attention span becomes the limiting factor, and Microsoft takes share of both work and fun as the lines blur between the two.

- The Office Suite, ERP Systems (Dynamics), and Teams all drive the 600%+ productivity that every SaaS company strives to provide and serve as foundational workload platforms on top of Microsoft's cloud.

- Bing and its indexing and search abilities bring together data across all segments and the broader internet.

The synergies go on and on. And with AI success predicated upon data volume, input sources, compute resources (for training purposes), model accuracy, and output leverage (line of business applications), Microsoft is in an unparalleled position to continue developing, deploying, and scaling leading AI across these business lines.

3) Acquisitions Fueling Continued Growth

The Office Suite is known for its generational defining productivity enhancements. Microsoft’s $26 Billion LinkedIn acquisition has already proven successful with revenue growth of nearly 100% from calendar year 2019-2022 (~$14.7 billion revenue projection for calendar year 2022). The network effects continue onward, justify an increasing paying customer base, and offer rich data for continued AI productivity advances.

Activision Blizzard?

While the $69 billion deal has been held up - Microsoft, if approved, is poised to take an increased share of the “metaverse” and capitalize on our ever growing time - currently 6+ hours a day - in front of digital media.

GPT! (AI is coming fast)

Microsoft’s $1 Billion investment in Open AI (the makers of GPT-3) is already looking like a homerun. Open AI and GPT-3 (with 175 billion model parameters) is rumored to be spending $3 million/month on Azure costs, and the Microsoft team has been working to scale Azure resource for the team. GPT-4 could be on the horizon for 2023.

It will take a few years for the commercialization of this technology across industries, and there will be great competition among the cloud giants - but Microsoft is in a leading position to capitalize and *profitably* deploy AI productivity benefits to customers across all of its operating segments.

4) Staying “Under the Radar”

What does the world look like when cloud computing is at a trillion dollar run rate and every single company and government runs entire operations on this compute/storage mesh layer? Regulatory and monopoly risk is one of the biggest downward pressures that cloud could face this decade.

It is very possible that $AMZN could reach $1 trillion in revenue on its own by the end of 2027. At some ~20% of US government inflows, operations spanning to compete with businesses in logistics, ecommerce, retail, and grocery, and management of some ~1.5 million employees, there is a greater regulation risk and operational/execution risk for Amazon then there is for Microsoft.

We see continued regulation efforts, and as the major cloud providers and tech companies exert their world influence - Microsoft's smaller revenue footprint may reduce long term regulation risk.

Microsoft - Strong Segment Growth and a 25% Upside in 2023 Price Target

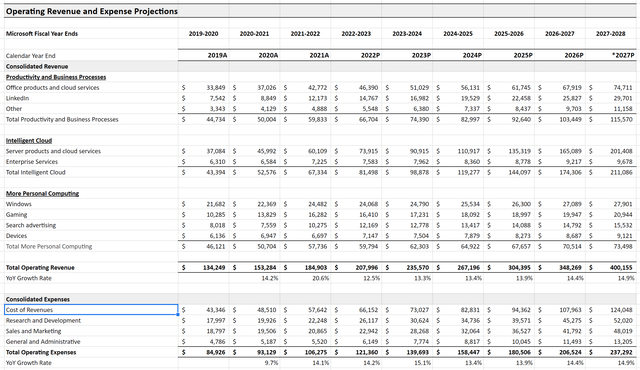

With the above factors in mind we project revenue growth as the following for 2027:

| Segment | Calendar Year 2027 Projected Revenue | CAGR |

| Office products and cloud services | $ 74,711 | 9.74% |

| $ 29,701 | 16.03% | |

| Other | $ 11,158 | 14.75% |

| Server products and cloud services | $ 201,408 | 22.33% |

| Enterprise Services | $ 9,678 | 4.99% |

| Windows | $ 27,901 | 2.20% |

| Gaming | $ 20,944 | 4.29% |

| Search advertising | $ 15,532 | 7.13% |

| Devices | $ 9,121 | 5.28% |

5 year revenue projections for Microsoft by segment (research.Layers.cloud)

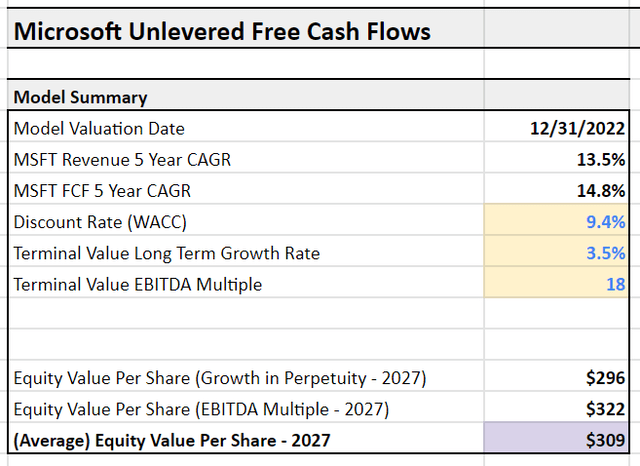

Microsoft has less variable and less capex intensive operations (compared with Amazon and its global ecommerce and logistics network operations). Keeping operating expenses, capex, and working capital growth in line with historical trends and their relationships to revenue, we discount cashflows to arrive at a price target of $296 per share for 2023.

An 18x exit multiple on 2027 EBIDTA also backs into a ~$320 per share price target for 2023.

Microsoft FCF Model Inputs (research.Layers.cloud)

The next year may be choppy, as the Fed continues its QT operations and rate raises. SaaS companies may come and go and their multiples may remain slashed. Companies will rightly be pulling back on spend and looking to optimize cloud resources.

But thematic trends all continue to play out for increased data volume, new cloud native company creation, the value and migration of enterprise workloads to the cloud, and AI's increasing productivity. Microsoft has demonstrated its ability to profitably take advantage of these trends, and continues to do so at a 40% operating margin.

At ~$240/share Microsoft offers an incredible entry point to take advantage of cloud's continued growth this decade with a 25% price target upside ($300/share) for 2023.

Comments ()